About

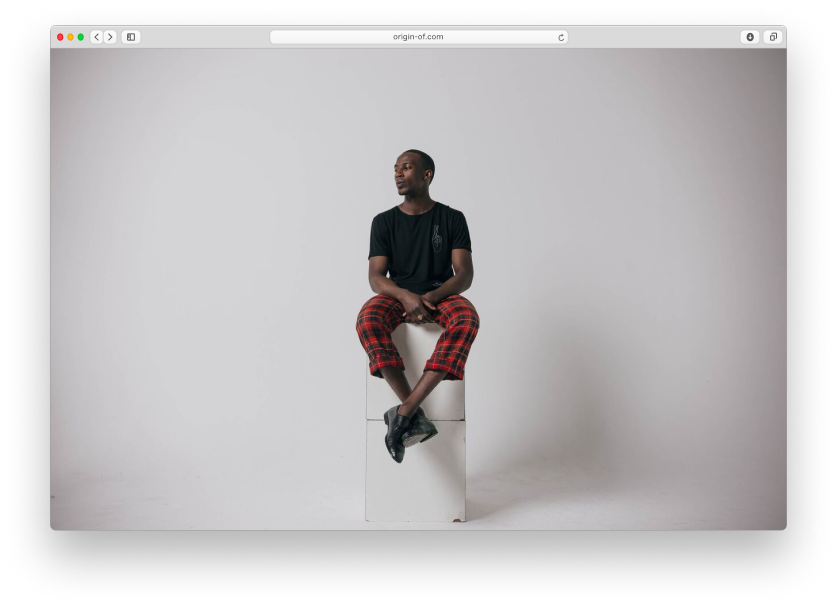

Alex is a product engineer and writer committed to building inclusive tech and teams. She is the founder of origin-of.com, using business to connect communities and inspire creative dialogue around social crises.

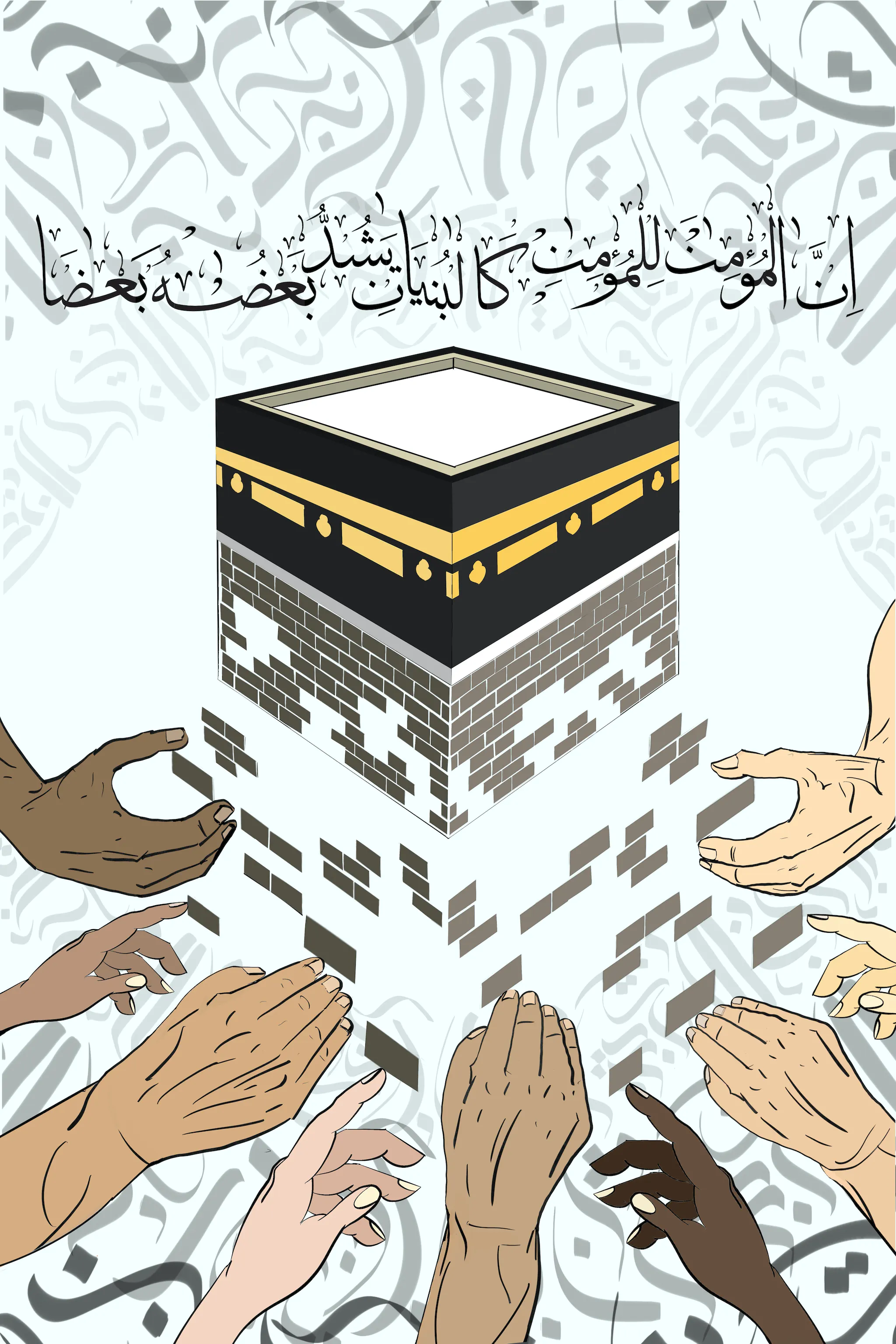

Alex is committed to better engage, support, and foster community through personal transformation and service. She regularly hosts conversations around faith, identity, and justice in partnership with Muslim leaders and thinkers around the world.

When not coding she contemplates life and love in her essays, with published work in The Common, Ruminate, Kweli Journal, and others. She is passionate about racial equity and Oakland.

Twitter: @alalafox

Twitter: @alalafox

Instagram: @alalafox

Instagram: @alalafox

LinkedIn:

@alexandfox

LinkedIn:

@alexandfox